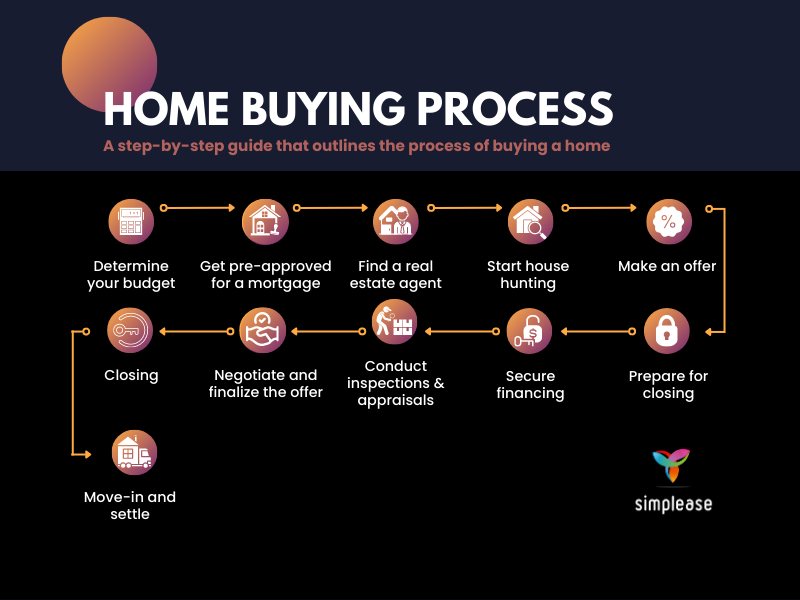

Home-Buying Process

A detailed guide to buying your home without missing out on anything important!

The home-buying process is a thrilling and important life milestone. Whether you are an experienced investor or a first-time homebuyer, navigating the difficult process of discovering and buying a property may be both thrilling and overwhelming. Each step involves careful thought and attention to detail, from setting your budget and analysing your needs to finding the ideal home and negotiating the conditions of the sale. We will discuss the main steps in the home-buying process and throw some light on the crucial variables that go into making a successful and satisfying home purchase. You can begin this journey with confidence and make wise decisions by being aware of the processes required and getting the correct advice that align with your goals.

Step 1: Determine your budget

Evaluate your financial situation, including savings, income, and expenses, to determine how much you can afford to spend on a home.

Step 2: Get pre-approved for a mortgage

Contact lenders to get pre-approved for a mortgage loan. This will give you an idea of how much you can borrow and help you narrow down your home search.

Step 3: Find a real estate agent

Seek out a reputable real estate agent who specializes in the area where you want to buy a home. They can help you find properties, negotiate offers, and guide you through the process.

Step 4: Start house hunting

Work with your real estate agent to search for homes that meet your criteria. Attend open houses, schedule private showings, and explore online listings to find potential properties.

Step 5: Make an offer

Once you find a home you like, work with your real estate agent to submit a written offer to the seller. The offer will typically include the purchase price, contingencies, and other terms.

Step 6: Negotiate and finalize the offer

The seller may accept your offer or counter with their own terms. Negotiate until both parties agree on the terms of the sale. Once the offer is accepted, it becomes a legally binding contract.

Step 7: Conduct inspections and appraisals

Schedule a home inspection to assess the condition of the property. Additionally, the lender may require an appraisal to determine the home’s market value. These steps help identify any potential issues or discrepancies.

Step 8: Secure financing

Work with your lender to finalize your mortgage application. Provide all required documents and complete any necessary paperwork. The lender will also order a title search and arrange for title insurance.

Step 9: Prepare for closing

Review all closing documents, including the settlement statement (HUD-1) and loan documentation. Coordinate with your real estate agent, lender, and attorney (if applicable) to ensure all necessary paperwork is in order.

Step 10: Closing

Attend the closing meeting, where you’ll sign all the necessary paperwork to complete the purchase. Pay any remaining closing costs, including the down payment and closing fees. Once all the documents are signed, the title will be transferred to your name.

Step 11: Move-in and settle

Congratulations! You are now a homeowner. Coordinate your move-in, update your address, and settle into your new home.

The thrill of owning and the feeling of satisfaction that comes from discovering your dream home make the process worthwhile, even though it might occasionally feel overwhelming.

Remember, this is a general overview of the home buying process, and the specific steps may vary based on your location and individual circumstances.

To read more such blogs, subscribe to our Newsletter!