Weekly Real Estate News Tracker- 13 May 2023

MUMBAI UPDATES

1. Piramal group seeks buyers for its distressed re portfolio

Piramal Group is seeking buyers for its distressed real estate portfolio comprising loans amounting to Rs 1,812 Crs and outstanding security receipts of Rs 782 Crs. Piramal Enterprises (PEL) and its subsidiary Piramal Capital & Housing Finance (PCHL) have jointly invited bids for their real estate portfolios.

Read more at : Piramal Group Seeks Buyers For Its Distressed RE Portfolio (rprealtyplus.com)

2. Maharashtra govt to frame policy on stalled real estate projects, gives push to self-redevelopment

Single window will be created in Mumbai for self-redevelopment, and applications will be processed within three months. Meanwhile, NAREDCO Maharashtra has welcomed the move by the govt.

Read more at : Maharashtra govt to frame policy on stalled real estate projects, gives push to self-redevelopment (moneycontrol.com)

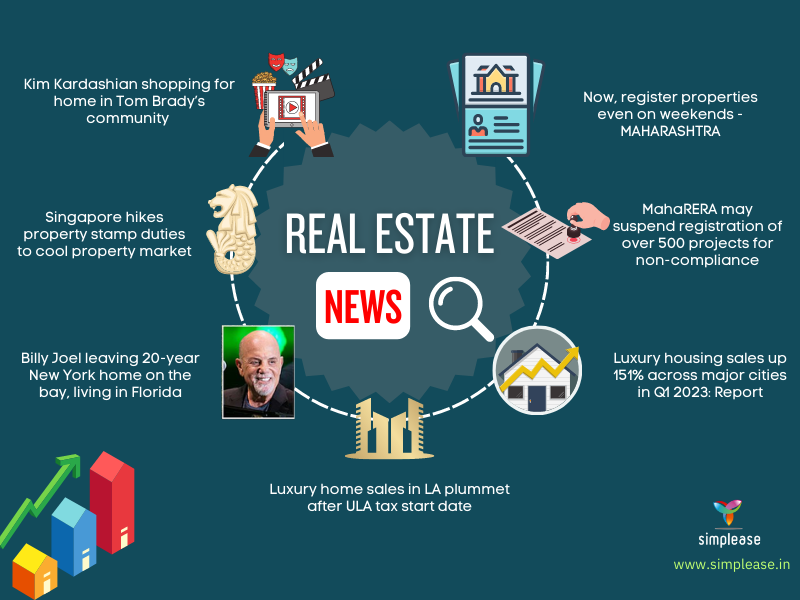

3. MahaRERA may suspend registration of over 500 projects for non-compliance

In a first, the Maharashtra Real Estate Regulatory Authority (MahaRERA) may temporarily suspend registrations of more than 500 real estate development projects registered in the state in January 2023, that have not uploaded the quarterly progress reports (QPR).

Read more at : MC Exclusive: MahaRERA may suspend registration of over 500 projects for non-compliance (moneycontrol.com)

4. Now, register properties even on weekends

Citizens will now be able to register their property documents on weekends too a s the state property registration department has decided to keep its 27 offices, including five in Pune and one in Mumbai, open on Saturdays and Sundays.

Read more at : Maharashtra: Now, register properties even on weekends, Real Estate News, ET RealEstate (indiatimes.com)

5. Ajmera Realty & Infra India Q4 Results: Net profit rises 8% YoY to Rs 15 crore

Realty developer Ajmera Realty & Infra India has reported 58% rise in net profit for the financial year 2022-23 at Rs 72 crore. Total revenue for the year saw a 10% decline to Rs 441 crore.

Read more at : Ajmera Realty & Infra India Q4 Results: Net profit rises 8% YoY to Rs 15 crore – The Economic Times (indiatimes.com)

NCR UPDATES

1. NCLT declares Supertech Ltd insolvent, 25K home buyers may be affected

The National Company Law Tribunal (NCLT) has declared Noida-headquartered realty major Supertech Ltd as insolvent while admitting a plea filed by the Union Bank of India over non-payment of its dues.The NCLT order is likely to hit over 25,000 homebuyers who have booked their homes with the company for over several years.

Read more at : NCLT declares Supertech Ltd insolvent, 25K home buyers may be affected (nationalheraldindia.com)

2. Transfer duty may go up for properties over Rs 25 lakh in Delhi

The proposal submitted to the Delhi government called for raising MCD’s portion of the transfer duty from the current 3% to 4% for men buyers and from the current 2% to 3% for women buyers.

Read more at : Transfer duty may go up for properties over Rs 25 lakh in Delhi, ET RealEstate (indiatimes.com)

3. Chintels Paradiso residents ask for changes in flat rebuild plan

Residents of Chintels Paradiso, where two persons died in a vertical collapse of flats last year, have demanded a revision in the settlement proposal offered by the developers.

Read more at : Paradiso Residents Ask For Changes In Flat Rebuild Plan, Real Estate News, ET RealEstate (indiatimes.com)

4. Residents of Supertech Ecovillage 1 in Greater Noida organise sit-in protest over pending demands

Residents of Supertech Ecovillage 1 in Uttar Pradesh’s Greater Noida West have resorted to an indefinite sit-in to protest the lack of basic amenities.

Read more at : Residents of Supertech Ecovillage 1 in Greater Noida organise sit-in protest over pending demands, ET RealEstate (indiatimes.com)

5. Failure to pay dues: Supertech CMD briefly detained; later released

According to district administration officials, recovery certificates worth Rs 33 crore were issued against Supertech by UPRERA which prompted the action.

Read more at : Failure to pay dues: Supertech CMD briefly detained; later released (moneycontrol.com)

INDIA UPDATES

1. Luxury housing sales up 151% across major cities in Q1 2023: Report

Luxury housing sales increased by about 151 percent annually in the January-March 2023 quarter, according to India Market Monitor Q1 2023 by real estate consultant CBRE. The report also highlighted a 12 percent quarter-on-quarter as well as annual growth in overall sales of residential units across all segments during the quarter.

Read more at : Luxury housing sales up 151% across major cities in Q1 2023: Report (moneycontrol.com)

2. Kolte Patil signs two residential projects in Pune with topline potential of Rs 1,300 crore

Pune-based listed real estate developer Kolte-Patil Developers Limited on May 10 announced that it has signed two new residential development projects in Pune, with a total estimated saleable area of 1.9 million square feet and a topline potential of Rs 1,300 crore. The projects are located in Wagholi (Nagar Road), and NIBM Road (Kondhwa) in Pune.

Read more at : Kolte Patil signs two residential projects in Pune with topline potential of Rs 1,300 crore (moneycontrol.com)

3. Nexus Select Trust REIT IPO Day 3: Issue fully subscribed at 1.44x; NIIs oversubscribe 1.63 times

Blackstone-backed Nexus Select Trust REIT’s Rs 3,200 crore IPO has been fully subscribed on Day 3 at 1.44 times. The QIB portion was subscribed 1.27 times, while the NII portion was overbid for 163%. The issue received bids for 26.6 crore units against 18.5 crore units on offer. The IPO will close for subscription on 11 May.

Read more at : Nexus Select Trust REIT IPO Day 3: Issue fully subscribed at 1.44x; NIIs oversubscribe 1.63 times | The Financial Express

4. Birla Estates acquires 28.6-acre land parcel in Bengaluru, eyes Rs 3,000 crore revenue

Birla Estates Private Limited, the real estate arm of the Aditya Birla Group housed under Century Textiles and Industries Limited has purchased a 28.6-acre land parcel in eastern Bengaluru with a potential revenue of Rs 3,000 crore, the company said in a regulatory filing.

Read more at : Birla Estates acquires 28.6-acre land parcel in Bengaluru, eyes Rs 3,000 crore revenue (moneycontrol.com)

5. K Raheja Corp, Aditya Shagun Developers to build 3 mn sq ft IT park in Pune

K Raheja Corp and Aditya Shagun Developers plan to develop a 3-million square feet Grade-A integrated IT Park in Pune’s Balewadi area and have completed a land transaction for this. The deal was facilitated by JLL India, a real estate consultancy firm.

Read more at : K Raheja Corp, Aditya Shagun Developers to build 3 mn sq ft IT park in Pune (moneycontrol.com)

6. NCLT-Chandigarh withholds merger of Embassy group firms with Indiabulls Real Estate

National Company Law Tribunal (NCLT)-Chandigarh bench has withheld the merger of NAM Estates and Embassy One Commercial Property Developments (Embassy One) into Indiabulls Real Estate (IBREL), the company informed in a BSE filing.

Read more at : NCLT-Chandigarh withholds merger of Embassy group firms with Indiabulls Real Estate, ET RealEstate (indiatimes.com)

GLOBAL UPDATES

1. Luxury home sales in LA plummet after ULA tax start date

According to a Multiple Listing Service data analysis, there were only two sales for single-family homes in the city above the $5 million tax threshold during April. This compares to 109 homes in the same price range in the preceding month of March. In April 2022, there were 50 sales.

Read more at : Luxury Home Sales Nosedive in LA After New Tax Takes Effect (therealdeal.com)

2. Singapore hikes property stamp duties to cool property market

Singapore raised taxes on private property purchases in a surprise move late on Wednesday night that includes a doubling of stamp duties for foreigners to an eye-watering 60%.

Read more at : Stamp Duty In Singapore: Singapore hikes property stamp duties to cool property market, ET RealEstate (indiatimes.com)

3.Invesco Real Estate’s US value-add fund closes at $2bn

Invesco Real Estate has closed its US value-add real estate fund at $2bn (€1.8bn), according to the fund manager. The manager said the Invesco Real Estate US Fund VI fund’s total capital commitments at close was $1.98bn. The capital raise exceeded the fund’s $1.5bn target and $1.75bn hard cap.

Read more at : Invesco Real Estate’s US value-add fund closes at $2bn | News | Real Assets (ipe.com)

4. Greater Miami Residential Sales Down 36 Percent Annually in March

The Miami Association of Realtors is reporting this week that greater Miami area total residential sales decreased 36.2% year-over-year in March 2023, from a high of 3,939 total transactions in March 2022 to 2,513 in March 2023.

Read more at : Greater Miami Residential Sales Down 36 Percent Annually in March – WORLD PROPERTY JOURNAL Global News Center