Mumbai Real Estate: Juggernaut continues in July 2022!

Mumbai Real Estate: Juggernaut continues in July 2022!

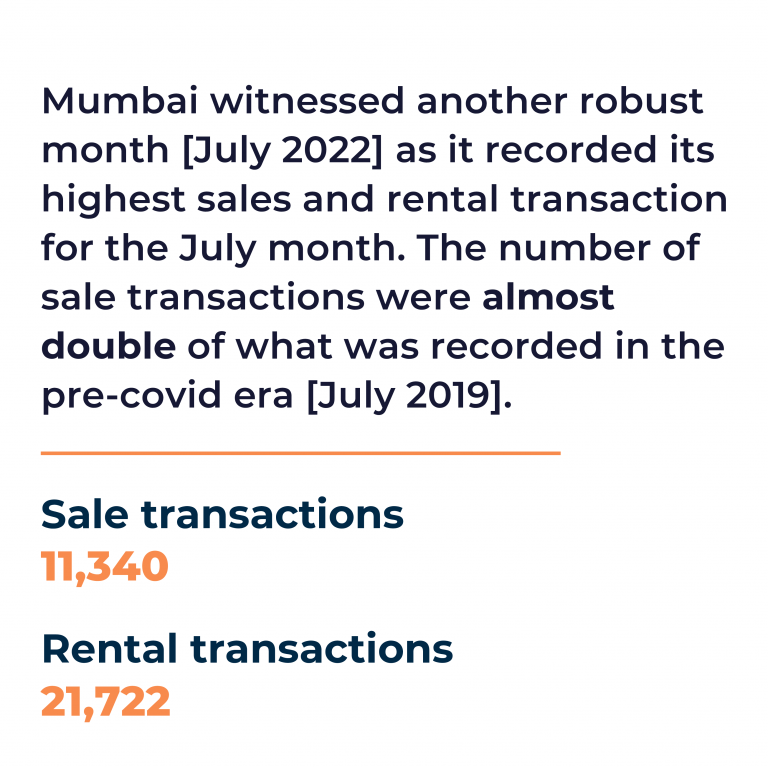

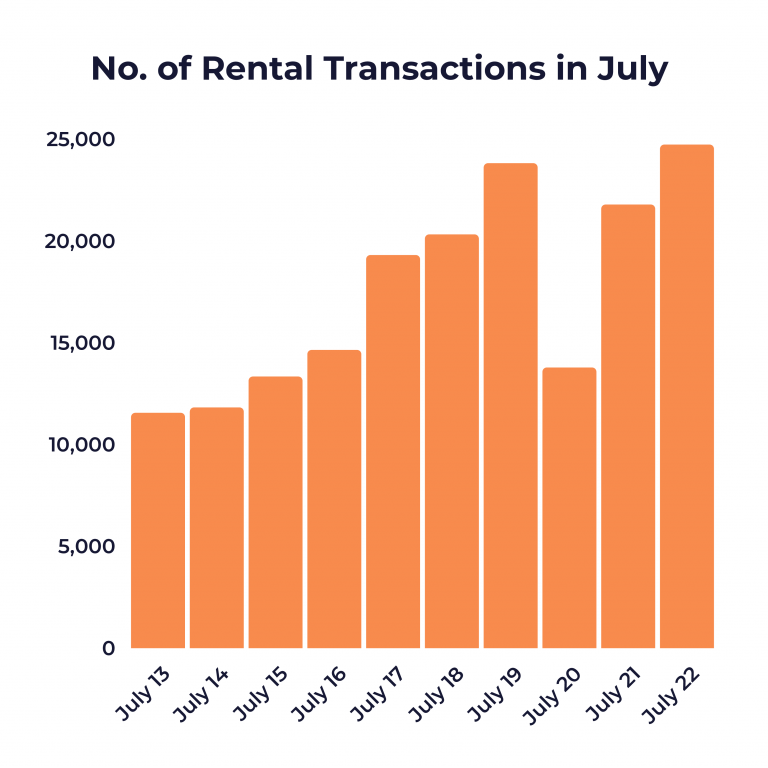

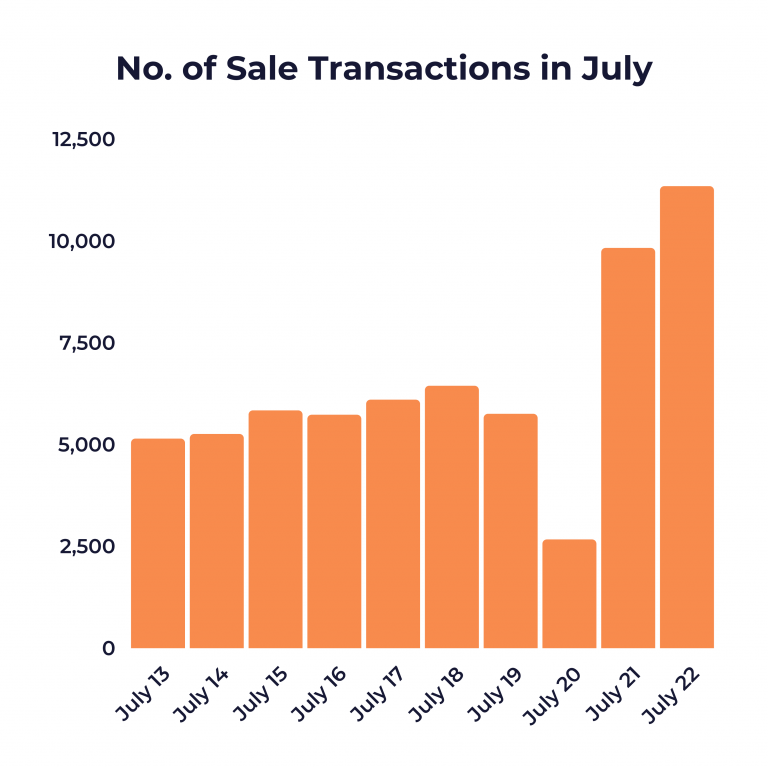

It seems to be raining Transactions this monsoon in Mumbai as both Rental and Sales hit a record for the July month.

Sale transactions in July 2022 were almost double the number achieved in pre covid era [July 2019] while the Rental transactions in July 2022 were 14% higher year-on-year.

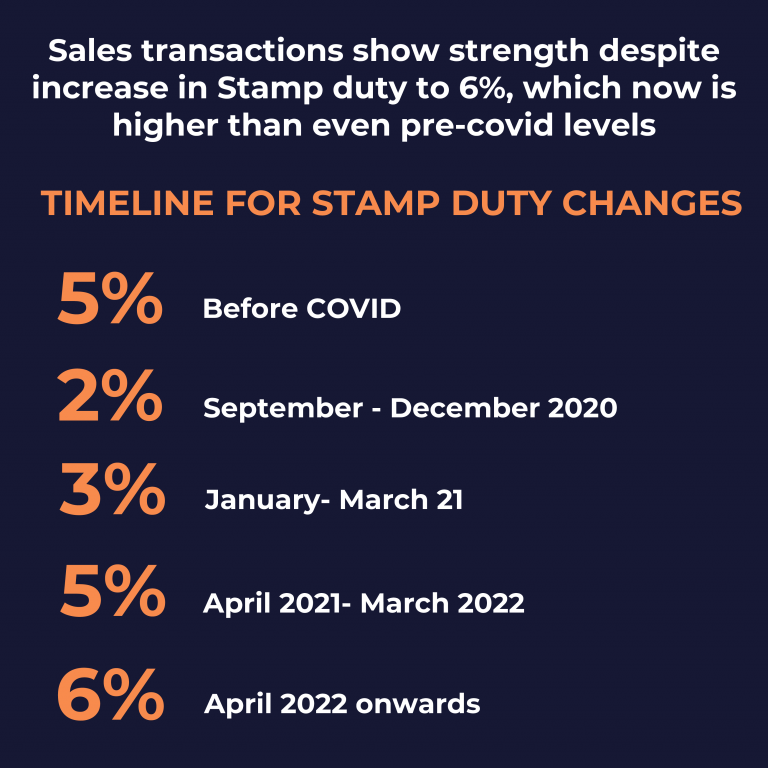

However, an interesting phenomena that has played out in the background is how the State Government has craftly played around with the stamp duty to manage its revenues from this all-important source.

Given below are the Government revenues from sale transactions:

> 2018: Rs5,654 cr

> 2019: Rs5,446 cr

> 2020: Rs3,138 cr [Reduced stamp duty from 5% to 2% for Sep-Dec 2020

> 2021: Rs6,111 cr [Stamp duty restored to 5% from April 2021]

> 2022 till July: 5,281 cr [Stamp duty increased to 6% from April 2022]

The initial reduction gave a much-needed boost to transactions. However, now with a strong momentum in place it has increased the stamp duty to benefit from both the higher volumes and higher rates.

This takes us to an often-debated question in economic circles of whether a reduction in taxes increases government revenue. Also known as “Reaganomics” (after US President Ronald Reagan)/ “trickle-down economics”, the proponents of this policy argue that reduction in taxes results in excess saving trickling down which eventually results in stimulating the economy and revenues.

The same rationale was provided by the current govt when corporate tax rates were cut in the 2019 budget by stating that “Tax concessions will bring investments in Make in India, boost employment and economic activity, leading to more revenue,”

While the jury is still out on whether reducing taxes increases revenue but at least the verdict is out on its effect on the Mumbai Real Estate sector!!!

Related Posts

Weekly Real Estate News Tracker – 23 July

Weekly Real Estate News Tracker- December 25, 2022