The Indian Journey of GST

The history of India’s Goods and Services Tax (GST) is a fascinating journey that has changed the nation’s taxation structure. The GST, which went into effect on July 1, 2017, is an extensive indirect tax imposed on the supply of goods and services in India. Its implementation marked a crucial turning point in India’s economic history by unifying the complicated network of several state and federal taxes. The GST timetable demonstrates the country’s commitment to supporting economic growth, harmonising taxation, and building a single market for all domestic firms.

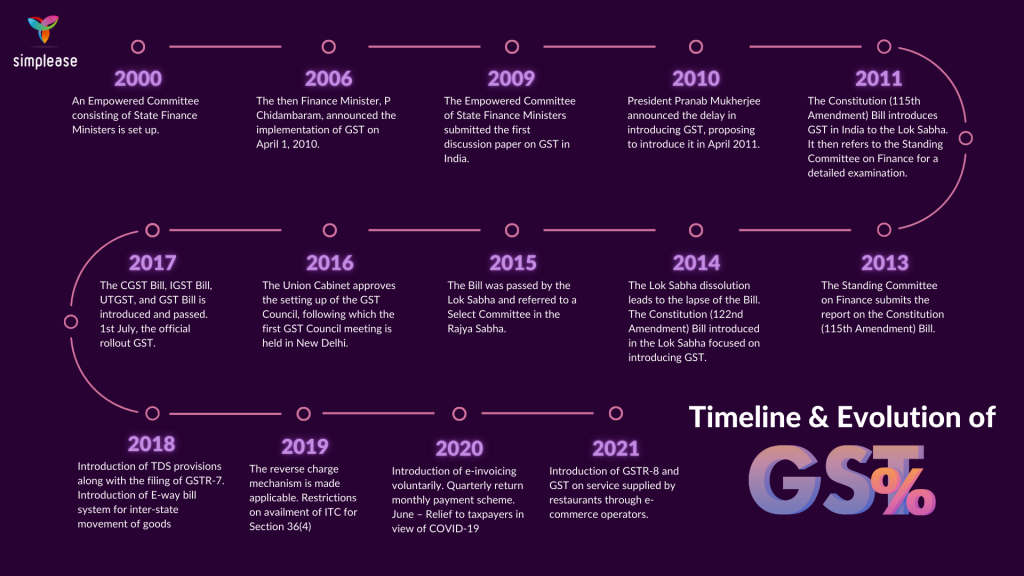

The Evolution Of GST in India

2000

It is decided to form an Empowered Committee made up of State Finance Ministers.

2006

P Chidambaram, who was the finance minister at the time, said that the GST will go into effect on April 1.

2009

The first discussion paper on the GST in India was submitted in 2009 by the Empowered Committee of State Finance Ministers.

2010

In 2010, President Pranab Mukherjee proposed delaying the implementation of GST and introducing it in April 2011.

2011

Saw the Lok Sabha’s presentation of the Constitution (115th Amendment) Bill, which was centred on the implementation of the GST in India. The Standing Committee on Finance would thereafter review the Bill in detail after being referred by the Lok Sabha.

2013

The report on the Constitution (115th Amendment) Bill is submitted by the Standing Committee on Finance.

2014

The Lok Sabha dissolution leads to the lapse of the Bill. The Constitution (122nd Amendment) Bill introduced in the Lok Sabha focused on introducing GST.

2015

The Bill was passed by the Lok Sabha and referred to a Select Committee in the Rajya Sabha. The Select Committee submits the report. Chief Economic Advisor-led Committee submits a report on the possible GST rates.

2016

The Bill is passed by both the Lok Sabha and the Rajya Sabha and is then notified as the Constitution (101st Amendment) Bill. The first state to ratify the Bill in Assam. President Pranab Mukherjee gives his assent to the Bill. The Union Cabinet approves the setting up of the GST Council, following which the first GST Council meeting is held in New Delhi.

2017

The Lok Sabha receives the introduction of the CGST Bill, IGST Bill, UTGST Bill, and GST (Compensation to States) Bill.The GST Acts are notified once the Bills have been approved by the Lok Sabha and the Rajya Sabha. The GST Council announces the tax on goods and services as well as its rates. The official launch date of GST is July 1.

2018

TDS regulations are introduced together with the submission of GSTR-7 and the E-way bill system implementation for interstate movement of products.

2019

Application of the reverse charge mechanism

Restrictions on Section 36(4)

2020

ITC Availability

adoption of electronic invoicing

monthly payment schedule for quarterly returns

June: Taxpayers receive relief in light of COVID-19

2021

GSTR-8 and the introduction of GST on services provided by restaurants through e-commerce operators

GST on services supplied by State Govt. to their undertakings or PSUs by way of guaranteeing loans taken by them.

The GST has undergone a number of changes and modifications since it went into effect in 2017 in order to simplify taxation procedures, get rid of cascading effects, and promote a more uniform and open tax system. While there were difficulties and growing pains with the initial implementation, the government’s dedication to addressing issues and pursuing continual improvement has been essential to the GST’s development. The central and state government officials that make up the GST Council have been crucial in encouraging collaboration and reaching agreements among stakeholders. As a result, the GST has helped to improve tax compliance, streamline corporate procedures, and promote smooth interstate trade. Additionally, it has aided in the integration of the Indian economy, the advancement of a single market, and the reduction of economic distortions. It has aided in decreasing economic distortions, fostering a common market, and integrating the Indian economy. In India, the GST is still being developed, and more changes are anticipated to boost its efficiency, fix outstanding issues, and promote long-term economic growth. Globally speaking, the introduction and development of the GST in India represent a significant step towards a more effective, open, and inclusive taxation system, supporting the country’s progress towards a stronger and more affluent economy.

To read more such blogs, follow our Newsletter!